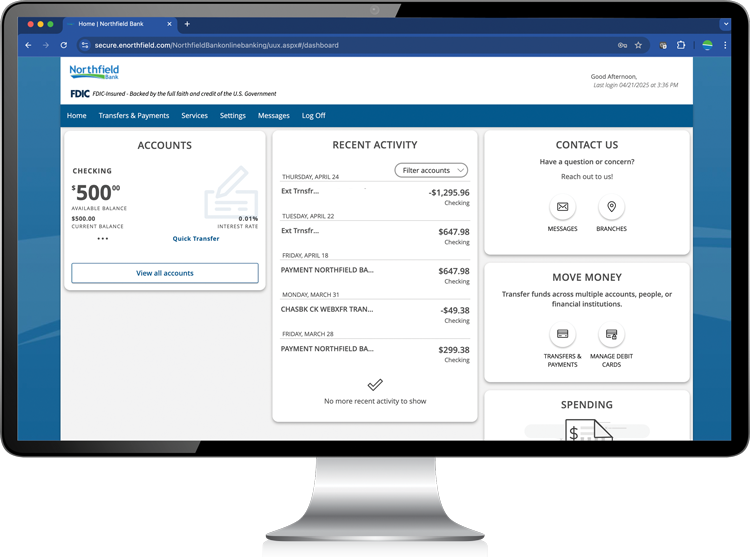

Northfield Bank is upgrading your Digital Banking experience on June 9th! Please review the information below related to Mobile Banking.

LOGGING IN FOR THE FIRST TIME ON OR AFTER JUNE 9TH

When you log in to Business Digital Banking for the first time on or after June 9th, please use the information below:

Login ID: Use your existing Login ID

Password: Enter your existing Password

Secure Access Code: A Secure Access Code will be sent to the email or phone number that are on file in your current Business Digital Banking account.You will then be prompted to verify your User Profile and change your password.

Please make note of your Login ID and Password prior to June 9th if you currently store them in your browser or utilize Face or Touch ID to access your account.

TOKEN USERS: If you currently use a token to log in to our existing Business DigitalBanking platform, please enter “Password” in the password field and the system will then issue a Secure Access Code and prompt you to reset your password. Going forward you will use your new password to log in to Business Digital Banking.

NOTE: You no longer will need to select “Business Online Banking” from the login box on our website, you may use your Business Digital Banking credentials in the new universal login box.

BUSINESS MOBILE BANKING

The new Business Digital Banking platform will include a Mobile App for business customers, with the ability to use Mobile Deposit Capture!

Users can download the Northfield Mobile App from the iOS App Store or Google Play Store after 9:00am EST on Monday, June 9, 2025.

SMALL BUSINESS BILL PAYMENT

Your existing Bill Payment Vendors/Payees and E-Bills will be transferred to the new Business Digital Banking platform and no action is required on your part.

If you currently use our Small Business Bill Payment platform with more than one employee, a CompanyAdministrator will need to first login to our new Business Digital Banking platform to assign the other company users the appropriate access prior to those users accessing the Bill Payment platform.

ACH AND WIRE CUSTOMERS

Business Digital Banking users that approve wires and ACH will require a new physical or digital token that has been, or will be issued by Northfield. If you have not been contacted regarding your new token, please reach out to your branch or Business Development Officer.

Please note, activity transaction history (transactions such as wires or ACH) from our existing system will not carry over to the new system.

For wire and ACH approvers that use digital or physical tokens, the first time you enter the token to approve a transaction, you must enter the first token number, then you need to wait for it to refresh and enter the next token. This is for only the first time the token is being used.

CHECK POSITIVE PAY WITH PAYEE RECOGNITION

Our new Check Positive Pay platform will feature payee recognition to mitigate risk and improve the overall experience.

Existing Positive Pay customers will be migrated to the new Business Digital Banking platform and check decisions for June 9, 2025 will be need to be submitted on the new platform.

REMOTE DEPOSIT CAPTURE USERS

Remote Deposit Capture (RDC) using your Northfield Scanner will not be available from June 6, 2025 at 4:00pm EST until 9:00am EST on Monday June 9, 2025.

As long as you are using the same computer where your RDC Scanner is already installed, there will be no configuration steps required after the upgrade to the new Business Digital Banking platform.

COMPANY ADMINISTRATORS AND ROLES

Business Digital Banking customers that have an Identified Account Administrator will have the ability to add or manage their employee users. If your company does not have an Identified Account Administrator, please reach out to your branch or Business Development Officer.

NEW SERVICES

Additional features will become available in the near future after June 9th. Please reach out to your Northfield branch or Business Development Officer to learn more about Zelle® for Small Business, ACH Positive Pay, Filters & Blocks, and Advanced Informational Reporting.