Simply Free Business Checking

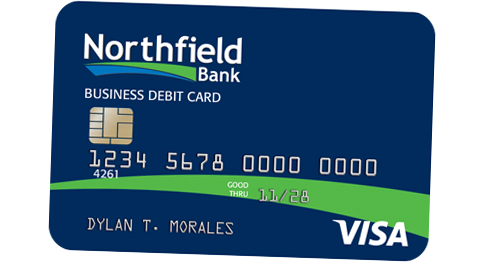

Northfield's Simply Free Business Checking(1) is perfect for most businesses. Simply Free Business Checking includes a free business debit card with uChoose Rewards, online & mobile banking, online bill pay, and online cash management.

Account Details

- 1,000 free monthly transaction items(2)

- No Minimum Balance

- No Monthly Service Charge

- Up to $10,000 currency deposited per month Free(3)

Getting Started

Account Highlights

-

Business Visa Debit Card

-

Positive Pay

-

Lending Services

Use your Northfield Visa Debit Card to keep track of everyday expenses. Plus, because the funds come directly out of your account there is no monthly bill to worry about.

Learn More

Northfield’s Positive Pay offers peace of mind for fraud prevention by letting you review incoming checks right as they’re posting.

Learn More

Leverage the experience of Northfield’s Small Business and Commercial Lending teams to help you obtain the financing you need for your business.

Learn More

Account Features

Visa Debit

Card

Use for everyday business expenses and earn points with uChoose Rewards.

Online

Banking

Bank on your time with online and mobile banking.

Account

Alerts

Real Time Account Alerts

Zelle® for Small Business

Zelle(4) for Small Business is a great payment option for you and your customers.